Shri Ram Finance is offering a personal loan for anyone at least 21 years old. Under this loan, you can avail up to 15 Lakh for a maximum tenure of 72 months at an interest rate of 12%, which may vary as per the loan amount and tenure you selected. It is a fully collateral-free loan, so forget assets mortgage term. You can submit the loan application online, which is fully digital and paperless, increasing the loan approval procedure.

A 3% processing fee is charged to process the loan. Shriram promised to process your loan within 72 hours after receiving the loan application. Upon successful approval, the loan amount is disbursed to your dedicated account. This loan comes with a lock-in period of 12 months. Read to learn its benefits, application procedure, and other details.

Shri Ram Finance Personal Loan

Before we proceed, let us quickly learn about Shriram Finance. Under Section 45, IB, Tamil Nadu-based Shriram Finance (formerly Shriram Transport Finance Limited) is registered with RBI and classified as an investor and credit company. They have been fulfilling Indian needs for 45 years and stand tall under various loan categories.

With 2975 branches, they mark their presence in every Indian City. As of September 2023, they distributed more than 2.02 cr loans to the needy. So, Shriram is a name you can bank upon for any financial needs across various categories.

Benefits of Shriram Finance Personal Loan

What is the basic expectation of a borrower when they apply for a personal loan are the main benefits of Shri Ram Finance Personal loans like the are providing:

Collateral-Free Loan: You need not mortgage any assets or guarantor for loan approval.

Quick Disbursal: The main aspect of lenders is how fast they process your loan from application submission to amount disbursement. At Shri Ram Finance, the loan is disbursed within 72 hours of receiving the loan application.

Interest Rate: What if you could get your dream loan amount at a competitive rate? Shri Ram Finance makes this dream come true with an annual interest rate starting at 12%.

Loan Tenure: With a maximum loan tenure of 72 months, which is five years, you can choose a loan tenure from 12-72 months per your needs.

EMI Reminder: If you forget the thing easily, don’t worry. Shriram EMI Alert will send your messages on and before the EMI date so that your credit score keeps soaring.

Digital Experience: Shri Ram Digital Online loan application made the process smooth and paperless. It may help to approve the loan quickly.

Shri Ram Personal Loan Types

The personal loan is unsecured and can be used for any personal needs. However, at Shri Ram Finance, you use the personal loan specifically for

- Wedding Loan

- Medical Emergency Loan

- Travel Loan

- Consumer Durable Loan

- Home Renovation Loan

- For students

- For Women

- For Child(s) future

- Festival Loan

Hero Finance Personal Loan: 5 लाख का लोन इतने काम ब्याज दर पर, सिर्फ इतने महीनों के लिए

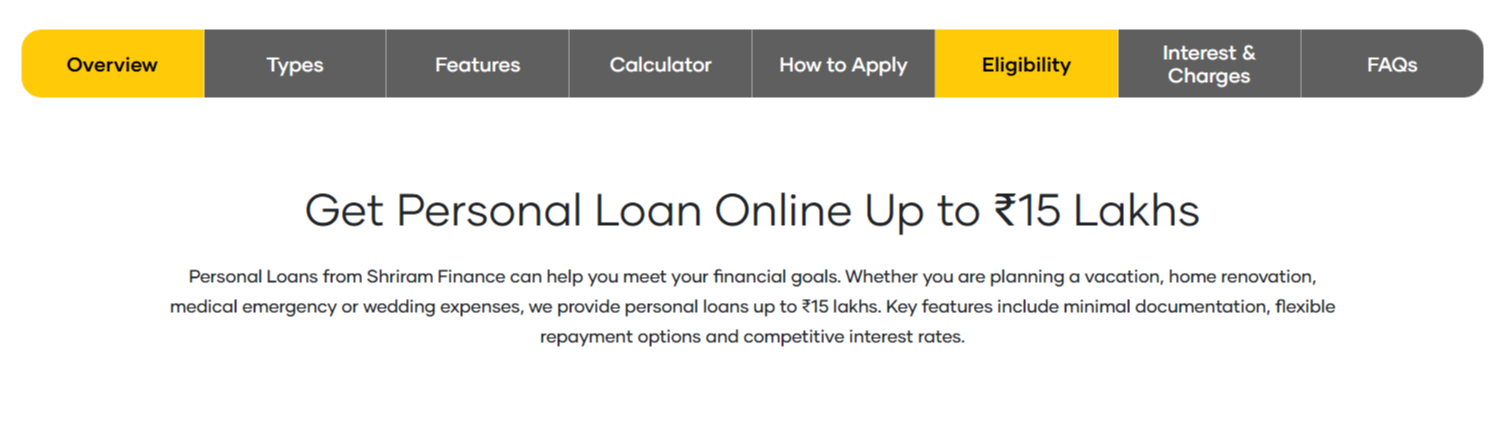

Eligibility Criteria for Shriram Finance Personal Loan

Nowadays, the loan application procedure is so smooth that everyone can qualify for it with a decent credit score. To apply for a personal loan, you must check all the boxes of criteria set by the lender. Failing to do so may lead to rejection of the loan application and hamper your credit score. So read it carefully, then proceed to apply.

- Any Indian resident that completed the age of 21 is eligible, whereas…

- the maximum age of such a resident is 60 years on loan closure.

- Any salaried or self-employed person may apply.

- Applicants must have a healthy credit score.

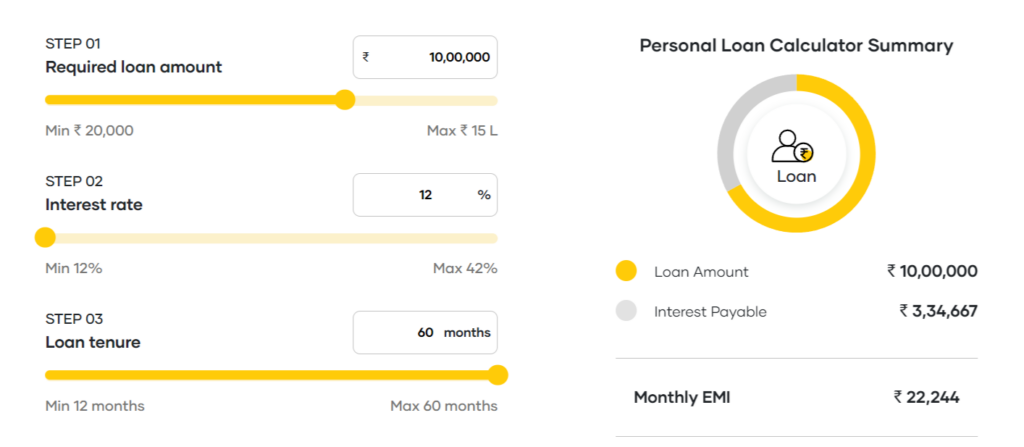

Calculate Shri Ram Finance Personal Loan EMI Online

Before application submission, you can calculate the loan EMI with the help of Shri Ram’s EMI Calculator. To do this, you need to open the EMI Calculator at the official portal of Shri Ram Finance.

- Enter the Loan Amount as per your need and tenure.

- For Example, if you need a 10 lakh personal loan for five years, then the EMI for this loan would be 22,444.

- It will also inform you about the total interest payable during the time. For more details, you can check the dedicated image shared below.

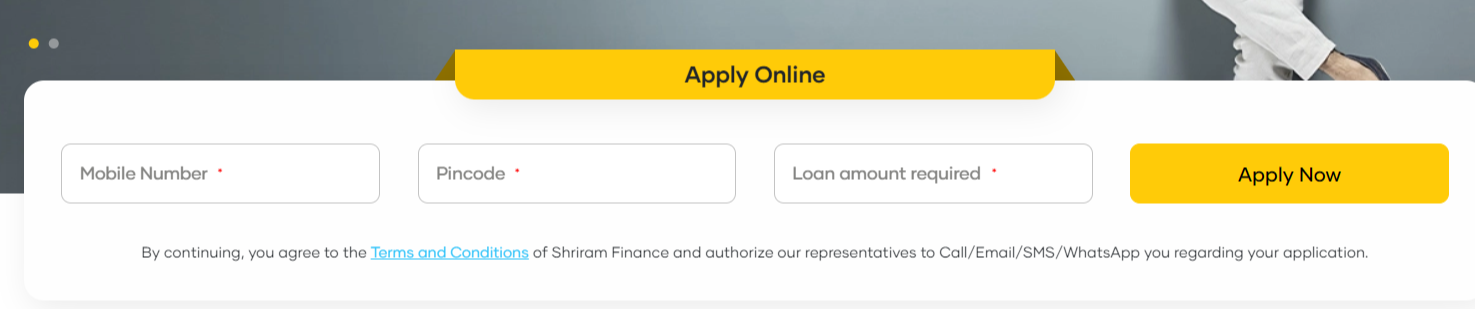

How to apply for a personal loan from Shriram Finance?

Submitting the loan application at Shriram Finance is simple and smooth. Visit their official portal and follow the details given here.

- Open the Shriram Finance Website.

- Under the loan tab on the home page, select the personal loan link.

- A new dedicated page of personal loans with its details appears.

- Read the loan details available on the page and proceed to apply.

- Applicants must provide their mobile number and PIN Code in the application procedure.

- Verify the mobile number with the OTP received. Upon confirmation, submit the loan amount and press Apply Now.

- Within minutes, you will receive a call from their executive, and they will process your loan after having some details and KYC.

PMEGP Loan Apply 2024: मोदी जी की सौगात! 30 लाख के लोन पर 35% माफ़ी, तरीका जान कर खुशी से झूम उठोगे

Documents required for a personal loan from Shriram Finance

To complete the application process, ensure you keep any one of the listed documents from each category.

- Identity Proof

- PAN Card

- Passport

- Voter ID Card

- Aadhaar Card

- Address Proof

- Utility Bills (Electricity, Water, or Gas Connection)

- Voter ID Card

- Aadhaar Card

- Driving License

- Other Documents

- Last three-month salary slip

- Latest Coloured Photograph

- Bank details (Last Six Months)

- One cancelled cheque and ACH form for eNACH.

Important FAQs

What is the maximum personal loan one can avail from Shri Ram Finance?

Up to 15 lakh, you can avail of a loan from Shri Ram Finance.

Can I apply for a multiple personal loan?

Yes! You can apply for multiple personal loans but only one at a time from one lender.

Can I use this personal loan for any purpose?

Yes! This personal loan is unsecured and can be used for any purpose.

How to apply for a personal loan from Shri Ram Finance?

You can apply for loan from Shri Ram Finance through their online portal.

Can I foreclose my loan account?

Yes! You can foreclose the loan account, but there is a lock-in period of 12 months.