PMEGP Loan Apply 2024: Are you bored with your 9-to-5 job and want to start your own business? If so, this PMEFP Loan is for you. Under the PMEGP, the Government is offering a subsidised loan of up to 50 lakhs for manufacturing units and up to 20 lakhs for service units. The subsidy is calculated based on the applicant’s category and where they belong to.

Applicants may apply for the projects prescribed under the scheme online or offline from the Khadi and Village Industries Commission (KVIC). Applications submitted other than the project mentioned in the portal will not be accepted.

Within 30 days of application submission, the respective allotted bank may approve or reject the loan application.

PMEGP Loan 2024

The central government backs the Pradhan Mantri Employment Generation Programme (PMEGP) to empower youth in rural and urban areas. Through this, they want to foster self-employment, which generates employment for others. Launched by the Ministry of Micro, Small and Medium Enterprises (MSME), it caters to various benefits to the beneficiary.

- Subsidised financial assistance of 50 lakhs and 20 lakh for Manufacturing and service units, respectively.

- Based on the area, the maximum subsidy allotted under the program is 35%.

- Applicants will get guidance, training, support, and assistance to run their units successfully.

- On top of that, the agencies that lend the loan are Public Sector Banks, Regional Rural Banks(RRB), Cooperative Banks, SIDBI, and Private Scheduled Commercial Banks regulated by RBI.

Pradhan Mantri Employment Generation Programme Loan

| Loan Amount | Manufacturing Units: 50 Lakhs Service Units: 20 Lakhs |

| Lock in period of Govt. Subsidy | 3 years |

| Application Procedure | Online and Offline |

| Number of projects available under the PMEGP Scheme | 1056 |

| Subsidy Rate | General (Urnban): 15% General (Rural): 25% Reserved Category (Urban): 25% Reserved (Rural): 35% |

| Minimum age limit | 18 years |

| Minimum Education Qualification | 8th Pass |

PMEGP Beneficiary Eligibility Condition

The authority has set some standards to apply for a loan, and those who adhere to it are welcome to apply. So, read the conditions accordingly and then proceed to apply.

For PMEGP New Enterprise Units

- Anyone above 18 years of age.

- To set up a project under PMEGP, there will be no income ceiling for assistance.

- The minimum education to set up a project costing ₹10 lakh in the manufacturing section and ₹5 Lakh in the Business or service section is VIII standard.

- Assistance under the scheme is provided to the new projects sanctioned under the PMEGP.

- Existing units or units already receiving a subsidy under the government scheme are not eligible.

- Under the new scheme, a finance facility is unavailable for projects without capital expenditure.

- The land cost will not be counted in the project cost. However, the cost of a ready shed or rental work shed/workshop is eligible in the project cost but for a maximum period of 3 years.

- New microenterprises include village industries, but not the prohibited ones are applicable under PMEGP.

- Only one application from each family is eligible for the loan to set up projects under PMEGP.

For existing units, upgradation

- Subsidy issued under PMEGP is adjusted successfully in the lock-in period of 3 years.

- The previous loan issued under the PMEGP was repaid successfully at the given time.

- The unit must be profitable with a good turnover.

Identification of Beneficiary

- Authorities at the respective state or district level and bank may identify the beneficiaries.

- Applicants who have undergone training for at least ten days (offline) or 60 hours online will not be required to undergo EDP training again.

- Preference is given to applicants who are affected by natural calamities.

Documents list for PMEGP Loan

To complete the application procedure, the applicants must keep their documents in scanned form as listed below. Ensure the size of the scanned file does not exceed 1 MB.

1. Latest Passport Size Photograph.

2. Highest Educational Qualification.

3. Project Report Summary/ Detailed Project Report

4. Social/ Special Category Certificate, if applicable.

5. Rural area certificate, if applicable.

How to submit a PMEGP Loan Application?

Applicants may submit their applications online upon satisfying the eligibility and other conditions. Said projects align with the scheme, so meeting the general or reserved category guidelines is necessary. Before applying online or offline, collect all the documents required for the application.

You can submit the PMEG Loan application online or offline as needed.

Online Application Procedure

Visit the Website: Applicants must visit the Khadi and Village Industries Commission (KVIC) website to apply online.

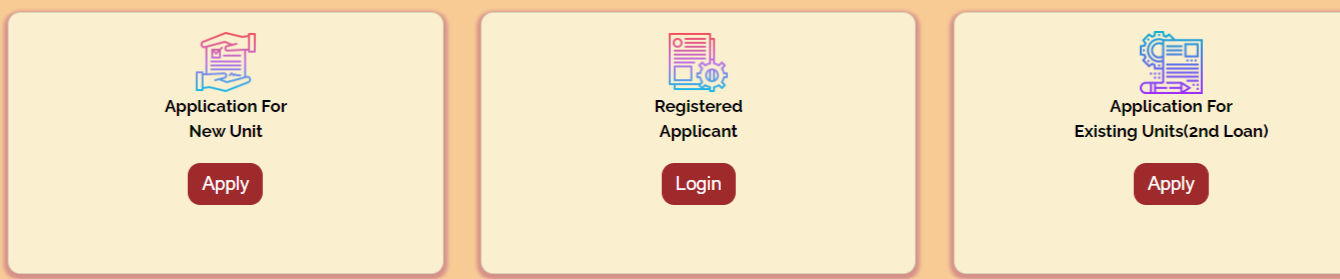

Choose the option: From the home page, select the “application for new unit”

Enter the details: On selecting the PMEGP Loan Application Form appears.

Save the application form: Applicants must enter their personal and other details in the given application form and upload the requisite documents supporting their identity and project.

User Name: Save the application form after uploading the details and documents. The portal then generates your username and password, which you can use to log in.

Final Submission: After reviewing the submitted application form, ensure that the details are true to your knowledge and as written in the documents before submitting it. After final submission, you will get the user ID and password.

Print the form: You can print the PMEGP Loan application form for future reference.

Submit PMEGP Loan Application for New Unit

Offline application

For offline, they approach the nearest District Industries Centre or Khadi and Village Industries Commission (KVIC) office. And submit the filled-in application form along with the requisite documents.

Post PMEGP Loan Application procedure

Once the authority receives the application, they will evaluate it thoroughly. Within 30 days of application submission, the bank may approve or reject your loan application. After approving the loan application, you will receive its intimation through an Email letter.

Such shortlisted applicants need to undergo the prescribed EDP training (if required). Soon after the completion of EDP training, the bank disburses the first installment. So, it is beneficial for the application to take such training after the application submission without waiting for loan approval.

What is the maximum loan amount under a project?

Rs. 50 lakhs are for manufacturing, and 20 lakhs are for service units.

Can I apply for any of the projects under PMEGP?

No, there are some predefined projects under which the applicants may avail of the loan.

What benefit will I get under the PMEGP Scheme?

Benefits like subsidised loans, training, assistance and much more are available under the scheme.

My.lone 500000

Mujhe rojgar ke liye 30lc ka loan chahiye

Apply Kariye mil jaiga loan.

kirana store Ke liye loal chahiye wipar ke liye

Mil jaiga